OK, “dead” may be a bit premature, but it is surely in decline. Â And, unless you are Oracle, SAP, HP, or similar, you’re not a software company, you’re just a feature awaiting a lingering death or a future acquisition.

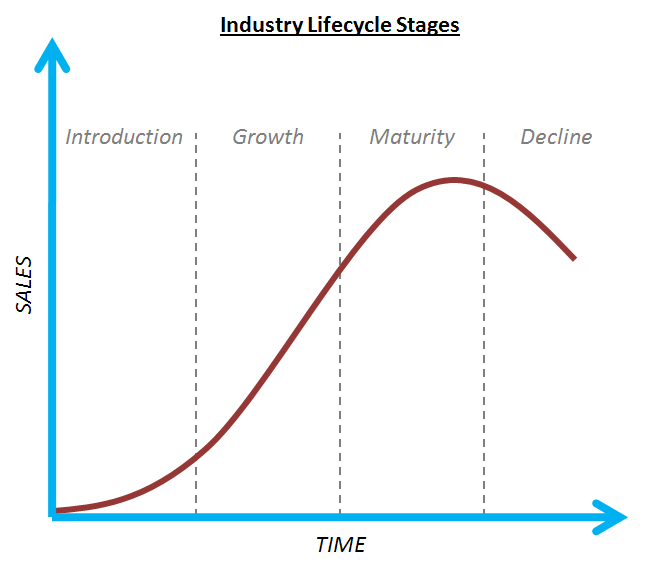

The Investopedia defines the final stage of the “industry lifecycle,” decline, as: “revenues declining; the industry as a whole may be supplanted by a new one.”  While Oracle’s revenues are definitely not declining, it’s becoming increasingly rare to hear of an enterprise-focused software firm that is doing well.  Sure, there are the SuccessFactors and QlikViews of the world, but it seems that Silicon Valley is bursting with enterprise software companies (SaaS and non-SaaS) that are doomed to limp along as the VCs continue to pump more money into the dream of next year’s hockey stick revenue chart (which is why the traditional VC model is dead, too).

There is a nice paper by a group at MIT’s Sloan School of Business that covers this industry’s decline in great detail, and shows how software companies have grown more and more dependent on services revenue for growth while license sales (as a % of total revenue) have steadily declined since the late ’90s.

The Feature as a Business Model

While the software world is stampeding towards an app-based economy on the consumer side (more on that in a future post), today’s enterprise software start-ups can succeed in only one way – by building their business on a killer feature missing from the entrenched leaders’ solutions (read: Oracle, IBM, SAP, Microsoft, Google, etc.), then hope that they are acquired by one of those leaders. If a start-up’s key functionality or value prop is matched or trumped by a market leader, that start-up is done.

There are dozens (if not hundreds) of these doomed start-ups in Silicon Valley, scrounging up a few million (<50) dollars in annual revenue (with cash-flow positive always just three quarters away), churning through employees and executives every few years, and living on VC money until, around year six or seven, they either put themselves up for sale at a fraction of the invested capital or they simply close their doors.  Hell, I’ve worked for a few of those, and most of my friends in Silicon Valley have been jumping between similar companies for most of their tech careers as well.

On one hand, we should thank the Googles and the Siebels and the rest of the successful Valley companies for creating the wealth to fund the traditional VCs, who then make the Silicon Valley economy possible at all. Â Since there is so much money available for investment, there are thousands of jobs created just to spend that money, even with incredibly flimsy business models to back them up (OH: “$3M revenue this year, $12M next? That’s impossible and insane, but it’s what the VCs want to hear…”). Â But I don’t want this to turn into a rant any more than it already has.

Bottom Line

The enterprise software industry is dead. Â The big guys own the market and are essentially the software equivalent of General Motors and Ford. Â The start-up pitch of “we’re going to disrupt/be the next gen/be version 2.0 of <insert successful software here>” or “we’re going after the $50 billion enterprise <insert solution here> market” is nearly impossible to achieve.

For those of us who work at enterprise-focused start-ups, it makes the effort of the entire team that much more important. Â There is zero room for slackers or 9-to5ers. Â The term “start-up” needs to return to it’s meaning as the description of a lifestyle, not it’s current meaning of a small company that provides snacks and foosball to employees.